When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. Major Factors that Influence Mortgage Eligibility

This is why it holds more weight when it comes to securing a mortgage deal. While pre-qualifying allows you to assess your readiness for a mortgage, pre-approval is a conditional commitment from a lender to officially offer you a loan. Pre-approved homebuyers are perceived to offer more financial reliability than pre-qualified ones. If you do not secure an offer within that time, you must reapply to get a pre-approval letter again. But take note: Pre-approval letters are only valid for 60 to 90 days. Sellers also request for a pre-approval letter once you’re ready to make a deal. Consumers who obtain pre-approval are perceived as more serious homebuyers. Once you receive a pre-approval letter, a lender approves a specific amount and includes a possible interest rate.

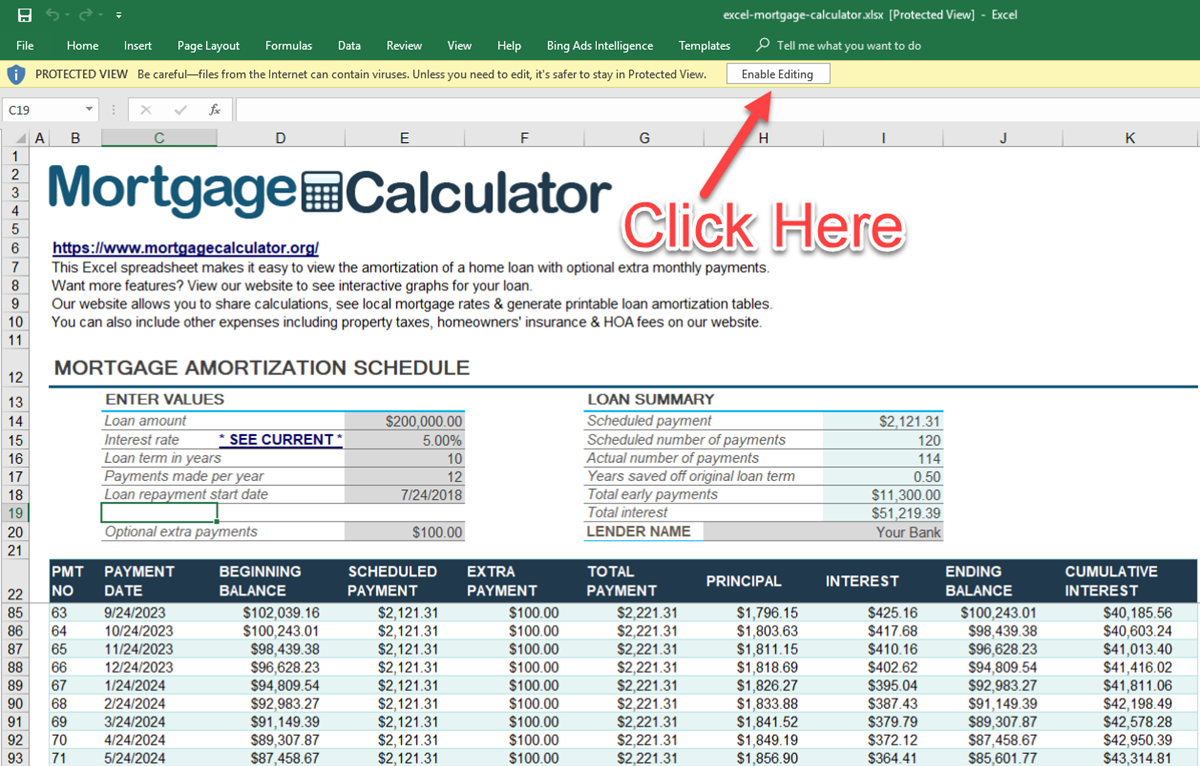

#Mortgage loan calc plus#

It’s also a plus if you can show a large amount of cash reserves and pay a high down payment.

But once your lender sees your income is high and sustainable enough, you can get approved. Lenders are concerned with the viability of your business and whether you can sustain monthly mortgage payments. You need to prove you have a reliable income source. In general, obtaining a mortgage when you’re self-employed can be more challenging. Furthermore, expect lenders to perform a hard credit check on your credit report, which means it can impact your credit score.įor those who are self-employed, lenders confirm your income by reviewing tax return transcripts from the IRS. Though most lenders only ask for a verbal confirmation, others might request for an email verification. They request for income information and other related credentials. Lenders verify your income and employment by directly contacting your employer.

It’s a vital indicator, especially for first time homebuyers who need to improve their credit status. Pre-qualification is a good way to know if you meet minimum requirements to secure a mortgage. They do not perform hard inquiries on your credit report, which means it does not affect your credit score. A lender reviews your income, assets, and debts based on self-reported information. It usually takes just one to three days and can be done online or over the phone. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan. And for first-time homebuyers, it’s crucial to get pre-qualified first to assess your general eligibility for a home loan. While both procedures similarly evaluate your creditworthiness, pre-approval has a greater influence on whether you can close a mortgage deal. These steps are called mortgage pre-qualification and pre-approval. The Mortgage Qualification ProcessĪspiring homeowners normally undergo two qualifying steps before they are approved for a mortgage. We’ll also talk about different types of home loans and their unique requirements, as well as other important information you need to know about qualifying for a mortgage. This includes your credit score, income, debt-to-income ratio, and your down payment. Our guide will introduce you to the basic mortgage qualifying process and discuss essential financial aspects you should prepare for. Mortgage lenders will evaluate your ability to repay your loan, as well as how much you might be able to borrow. And for most people, it can take decades to pay down a mortgage.īefore you can buy your own property, there are several steps you must take to qualify for a loan. It’s one of the most expensive major purchases you’ll make in a lifetime. The Consumer’s Guide to Qualifying for a Mortgageĭeciding to buy a house is a primary financial commitment.

0 kommentar(er)

0 kommentar(er)